What Are the Risks?

Before investing in high-yield bonds, you should understand the risks associated with them.

Credit risk is the potential for loss resulting from an actual or perceived deterioration in the financial health of the issuing company. Two subcategories of credit risk are default risk and downgrade risk.

Default Risk Defaults occur when a company fails to pay an interest or principal payment to a debt holder as scheduled and as specified in the legal agreements, i.e. the indenture. The risk of default on principal or interest, or both, is greater for high-yield bonds than for investment-grade bonds. Factors such as business cycle volatility, excessive leverage or threats from competitors may lead to default. In a corporate bankruptcy or dissolution, although secured bondholders and holders of senior debt issues may receive some distribution of corporate assets, it is rarely enough to “make whole” their total investment. Bonds of companies in default may trade at very low prices, if they trade at all, and “liquidity” may disappear.

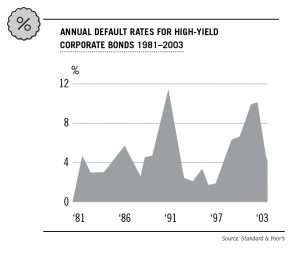

This chart tracks the annual default loss rate in high-yield bonds since 1981. The average default rate during this time period is approximately 4.6%.

Downgrade Risk Downgrades result when rating agencies lower their rating on a bond—for example, a change by Standard & Poor’s from a B to a CCC rating. Downgrades are usually accompanied by bond price declines. In some cases, the market anticipates downgrades by bidding down prices prior to the actual rating agency announcement. Before bonds are downgraded, agencies often place them on a “creditwatch” status, which also tends to cause price declines.

Interest rate risk affects fixed-income security prices, mainly when interest rates rise. Since prices of all market-traded bonds move counter to the direction of rates, rising rates cause bond prices to decline. Longer-maturity bonds are the most vulnerable.

Liquidity risk Liquidity refers to the investor’s ability to sell a bond quickly and at an efficient price, as reflected in the bid-ask spread. A difference may exist between the prices buyers are bidding and the prices sellers are asking on large, actively traded bond issues. The gap is often small, producing greater liquidity. As the spread rises on less actively traded bonds, so does liquidity risk. High-yield bonds can sometimes be less liquid than investment-grade bonds, depending on the issuer and the market conditions at any given time.

Economic risk describes the vulnerability of a bond to downturns in the economy. For example, in 1990, when the U.S. GDP went into a decline that lasted three consecutive quarters, the principal value and the total return of high-yield bonds declined significantly. Virtually all types of high-yield bonds are vulnerable to economic risk. In recessions, high-yield bonds typically lose more principal value than investment-grade bonds. If investors grow anxious about holding low-quality bonds, they may trade them for the highest-quality debt, such as U.S. Treasuries and investment-grade corporate bonds. This “flight to quality” particularly impacts high-yield issuers.

Company and industry “event” risk encompasses a variety of pitfalls that can affect a company’s ability to repay its debt obligations on time. These include poor management, changes in management, failure to anticipate shifts in the company’s markets, rising costs of raw materials, regulations and new competition. Events that adversely affect a whole industry can have a blanket effect on the bonds of its members.