Overview

After you decide to invest in bonds, you then need to decide what kinds of bond investments are right for you. Most people don’t realize it, but the bond market offers investors a lot more choices than the stock market.

Depending on your goals, your tax situation and your risk tolerance, you can choose from municipal, government, corporate, mortgage-backed or asset-backed securities and international bonds. Within each broad bond market sector you will find securities with different issuers, credit ratings, coupon rates, maturities, yields and other features. Each one offers its own balance of risk and reward.

Use this section to clarify the differences among your bond investment alternatives:

- Learn the ins and outs of different types of bonds in the comprehensive “Investor’s Guides” to various types of bonds

- Supplement your knowledge with product-focused industry research and articles

- Find out more about bond funds

To purchase Investor Guides in digital format as a site license, please visit: www.sifma.org/store.

The Role of U.S. Treasury Securities in an Investment Portfolio

The primary advantage of U.S. Treasury securities is safety. No other investment carries as strong a guarantee that interest and principal will be paid on time. Because these payments are predictable, many people invest in them to preserve and increase their capital and to receive a dependable income stream.

The benefit of predictability is enhanced by the fact that Treasuries generally do not have “call” provisions. In fact, the U.S. Treasury has not issued “callable” securities since 1985. Call provisions, common in municipal and corporate bonds, permit the issuer to pay off the bond in full before its scheduled maturity. This is especially likely to happen when interest rates decline, as an issuer will refinance its debt to obtain the lower prevailing interest rate. When that happens, the investor would be forced to pay more to earn the same interest rate. If you own Treasuries that have no call provisions, you know exactly how long your income stream will last.

Another advantage of Treasuries is that they are available with a wide range of maturity dates. This allows an investor to structure a portfolio to specific time horizons.

Because many consider them the safest investments available, Treasury securities pay somewhat lower interest rates than other taxable fixed-income investments. Many investors accept this as a trade-off for security. In a diversified portfolio, U.S. Treasury securities usually represent money that investors want to keep safe from risk.

An added benefit of Treasuries is that their interest payments are generally exempt from state and local income taxes (but not federal taxes). This has the effect of increasing the after-tax benefits of these investments. Investors in high-tax states should take special note of this benefit.

Another important characteristic of the U.S. Treasury market is its high level of liquidity, which means that Treasuries are easy to buy and sell. Because they trade so frequently in large volume, the spreads between what a dealer would be willing to pay and what a dealer would be willing to sell for is lower than for other securities. Lower trade transaction costs and more efficient price discovery (determining the best possible price for buyers and sellers) result from such great liquidity in the U.S. Treasury market, benefits which are ultimately translated to the individual investor.

What are U.S. Treasury securities?

U.S. Treasury securities are debt obligations of the U.S. federal government: when you buy a Treasury security1, you are lending money to the government for a specified period of time. Available in a variety of different forms – such as Treasury bills, Treasury notes, Treasury bonds, Floating Rate Notes (FRNs), and Treasury Inflation Protected Securities (TIPS) – these securities are commonly referred to as “Treasuries.”

Because federal debt obligations are backed by the “full faith and credit” of the government, and thus by its ability to raise tax revenues and print currency, U.S. Treasury securities are widely considered the safest of all investments. They are viewed in the market as having virtually no “credit risk,” meaning it’s highly likely your interest and principal will be paid in full and on time.

Treasuries generally offer lower interest rates than other widely traded, riskier debt securities, like corporate bonds. Remember: as a general rule, safer investments offer lower returns. Conversely, investments with higher risk offer a higher potential return (but that higher risk also brings a greater possibility of losses).

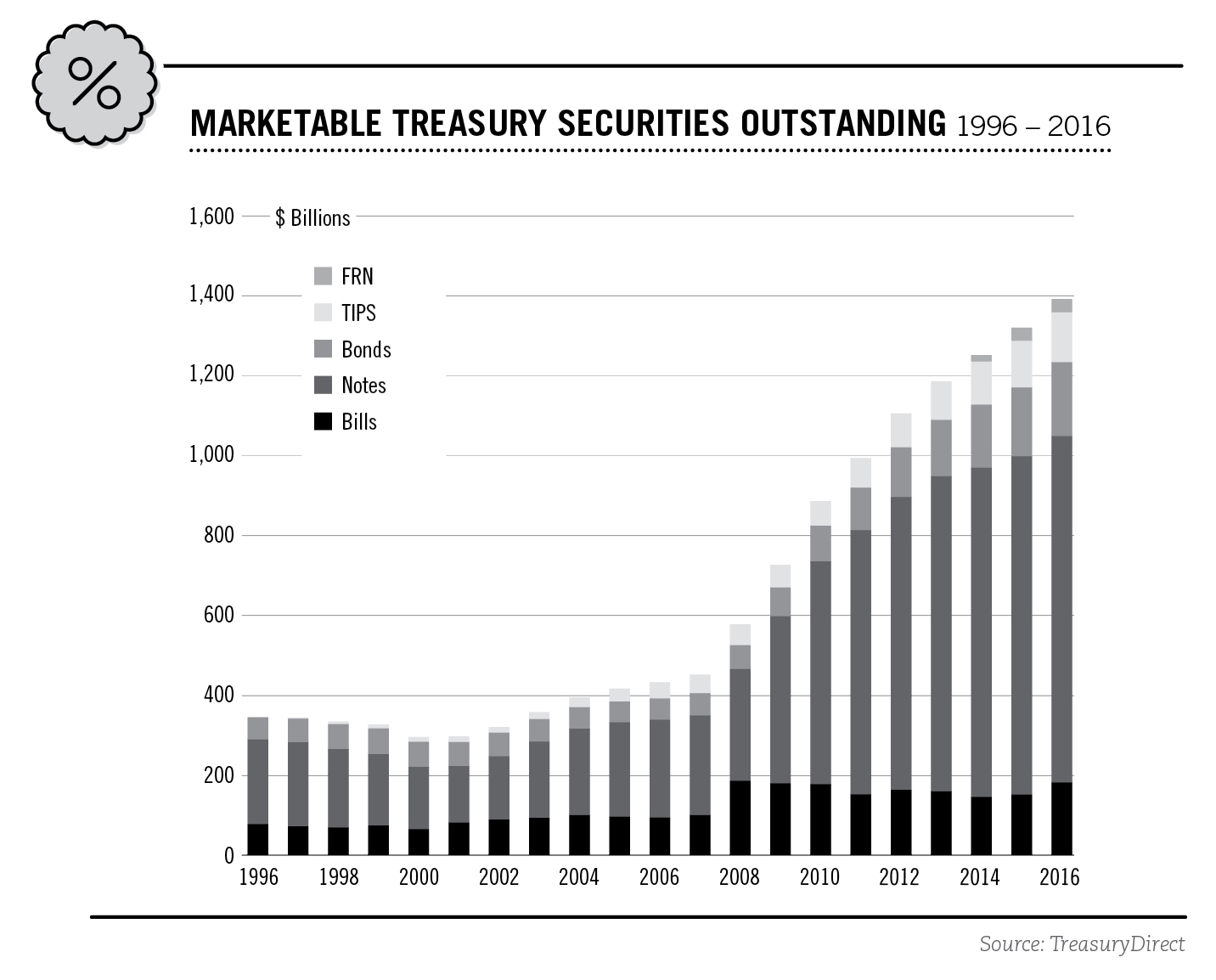

The total amount of marketable U.S. Treasury securities, that is Treasuries that trade on the open market, is massive with $13.9 trillion in outstanding bills, notes, bonds, FRNs, and TIPS as of December 31, 2016. The Treasury market is one of the world’s most liquid debt markets, meaning it is one where pricing, executing and settling a trade is highly efficient.

The average daily trading volume of marketable Treasuries was $514.22 billion in 2016. Because of their low risk of default and relatively high level of liquidity, Treasuries are popular with all types of investors. As of the end of 2016, the U.S. Federal Reserve estimated that 8.8% of bills, notes and bonds were held by individuals, 15.1% by banks and mutual funds, 14.5% by public and private pension funds, 38.2% by foreign investors, 4.5% by state and local governments and 18.9% by other investors.

This guide focuses primarily on marketable U.S. Treasury securities, which trade on the open market. There are other classes of Treasury debt, known as non-marketable securities, like U.S. savings bonds, that can be purchased from and redeemed by the government but are not transferable on the open market.

About Bills, Notes and Bonds

You don’t actually receive a certificate when you buy a U.S. Treasury bill, note or bond. Your investment is tracked in a book-entry system of accounts that generates a receipt and periodic statements. Investors should understand the differences among Treasury bills, notes and bonds.

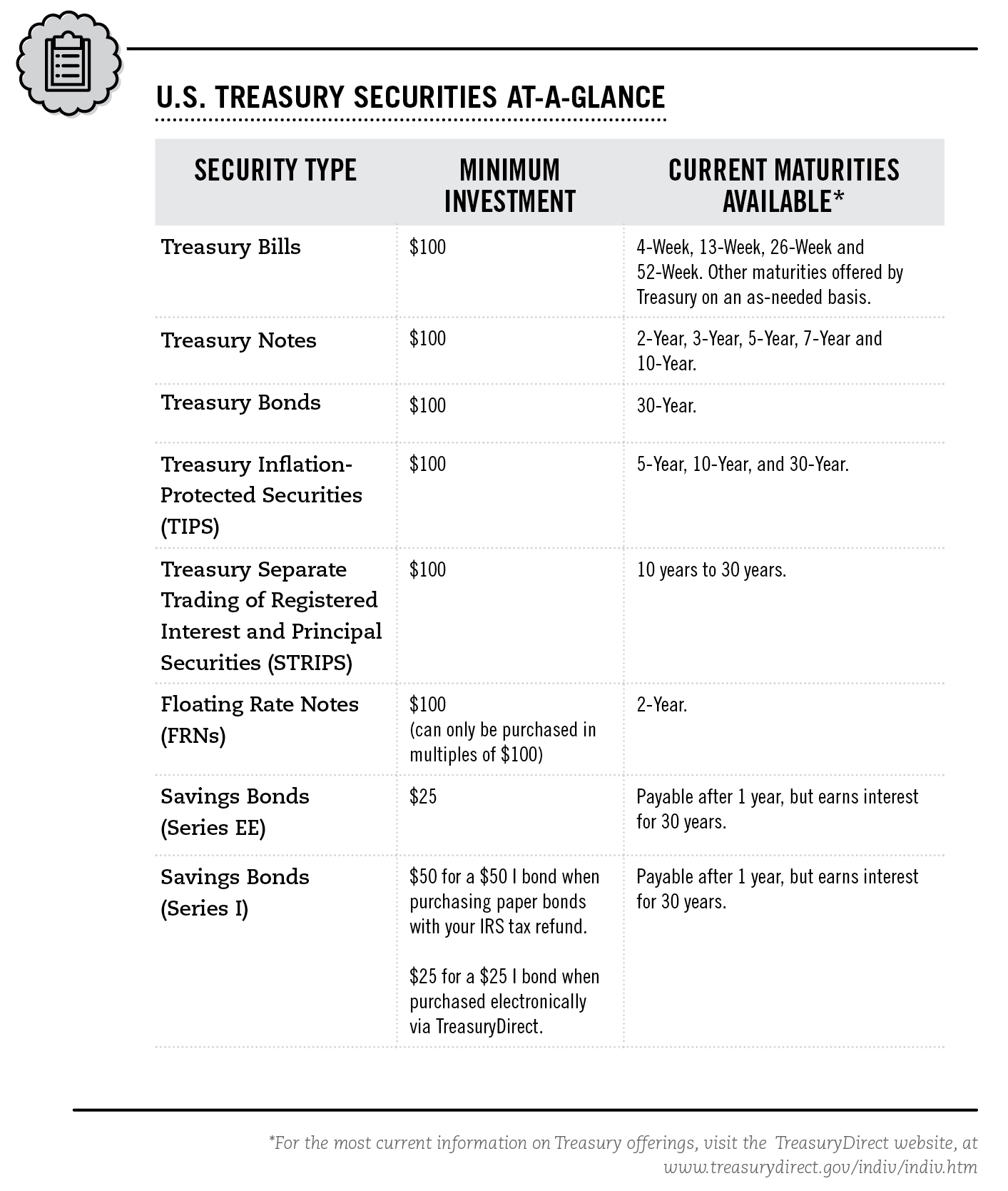

Treasury Bills, as the table “Treasury Securities at a Glance” indicates, are short-term instruments with maturities of no more than one year. They fill investment needs similar to money market funds and savings accounts. They could be a place to “hold” money an investor may need to be able to access quickly, for example in the event of an emergency. The Treasury bill market is highly liquid; investors can quickly convert bills to cash through a broker or bank. Treasury bills function like zero-coupon bonds, which do not pay periodic interest payments. Investors buy bills at a discount from the par, or face value, and then receive the full amount when the bill matures. For example, an individual could buy a 26-week bill that pays the full $1,000 at maturity for $970.28 at the time of purchase, effectively earning an annualized yield of 6.28% on the investment.

Treasury Notes are intermediate- to long-term investments, typically issued in maturities of two, three, five, seven and 10 years. These are typically purchased for specific future expenses, such as college tuition, or used to generate cash flow during retirement. Interest is paid semi-annually.

Treasury Bonds cover terms of longer than 10 years, and are currently being issued in maturities of 30 years. Interest is also paid semi-annually.

Why invest in U.S. Treasury securities?

Individuals can invest in a wide range of bonds, such as U.S. Treasury securities. A financial professional can explain the available options, taking into account investment goals, income needs, and risk tolerance.

Investors buy Treasuries for a variety of reasons:

- Credit quality. Because their risk of default is so low, individual investors buy Treasuries to preserve their capital while receiving a dependable income stream. While Treasury securities pay somewhat lower interest rates than other taxable fixed-income securities, many investors accept lower rates in exchange for a more secure investment. In a diversified portfolio, U.S. Treasury securities usually represent money that investors want to protect from risk.

- Predictability. Today’s Treasuries do not have call provisions. Call provisions, common in municipal and corporate bonds, permit the issuer to repay a bond before its scheduled maturity. This repayment risk is more likely when interest rates decline, as an issuer will refinance its debt to obtain the lower prevailing interest rate. When that happens, the holder of that bond would have to reinvest those proceeds at a lower interest rate, and therefore receive a lower income stream. Since Treasuries have no call provisions, you know exactly how long your income stream will last. The U.S. Treasury has not issued callable securities since 1985.

- Wide range of maturities. Another feature of Treasuries attractive to investors is that they are available with a wide range of maturity dates, allowing an investor to structure a portfolio to meet specific time horizons.

- Tax status. Treasury interest payments are exempt from state and local income taxes (but not from federal taxes).

SIFMA does not provide tax advice, and the foregoing is not intended to be a substitute for a consultation with a tax professional who knows the characteristics of the bond and your tax circumstances. A tax professional can help explain the tax implications of investing in Treasuries and other securities.

- Relative ease of buying and selling. The U.S. Treasury market has a high level of liquidity, so Treasuries are generally easy to buy and sell. Greater liquidity can lower trade transaction costs and enable more efficient price discovery between buyers and sellers.

Understanding risk and U.S. Treasury securities

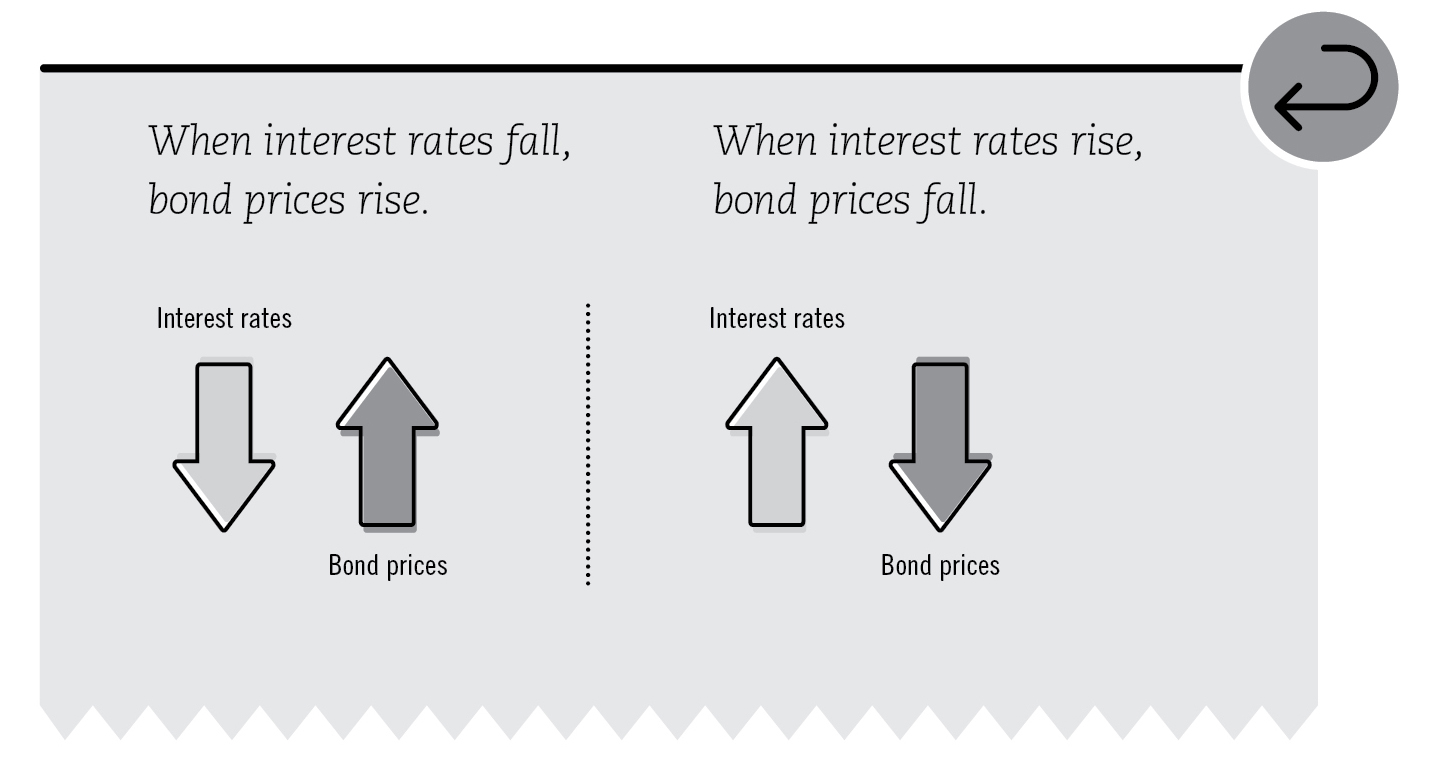

Although Treasuries have very low credit risk, they are affected by other types of risk—mainly interest-rate risk and inflation risk. While investors are effectively guaranteed to receive interest and principal payments as promised, the underlying value of the bond itself may fluctuate depending on prevailing interest rates.

As with all fixed-income securities, if interest rates rise after a U.S. Treasury security is issued, its value will fall, since new bonds entering the market will pay higher rates of interest. Similarly, if interest rates fall, the value of the older, higher-paying bond will rise in comparison with new issues.

Investors often are content to hold their bonds to maturity, disregarding the interim changes in the market value of their bonds.

Some investors structure their bond holdings to minimize the impact of interest rate risks and adjust their portfolio based on market opportunities. An example of this approach is a technique called laddering, which structures a portfolio so that securities mature at regular intervals, allowing the investor to make new investments with the cash available from the maturing securities.

In the event of rising inflation, which reduces the value of U.S. dollars, the relative value of U.S. dollar-denominated debt securities will also decline. To help investors deal with inflation risk, the U.S. Treasury has created inflation-indexed notes and bonds called Treasury Inflation- Protected Securities (TIPS), and inflation-indexed savings bonds called I Bonds. The principal of a TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index. When a TIPS matures, you are paid the adjusted principal or original principal, whichever principal is greater. Refer to About TIPS, STRIPS, FRNs, and

U.S. savings bonds, on page 10, for more information.

About Treasury bills, notes and bonds

As with most other securities investments, you won’t actually receive a physical certificate when you buy a U.S. Treasury bill, note or bond. Your investment is tracked in an electronic book-entry system of accounts that generates a receipt and periodic statements. Investors should understand the differences between bills, notes and bonds:

- Treasury bills, as the U.S. Treasury securities at-a-glance table on page 8 indicates, are short-term instruments with maturities of no more than one year. They fill an investment need similarly to a money market fund or savings account. A Treasury bill investment can be a place to “hold” money an investor may need to be able to access quickly, for example in the event of an emergency. The Treasury bill market is highly liquid; investors can quickly convert bills to cash through a broker or bank. Treasury bills function like zero-coupon bonds, which do not pay periodic interest payments. Investors buy a Treasury bill at a discount from the par, or face value, and then receive the full amount when the bill matures.

For example, an individual could buy a 13-week bill that pays the full $1,000 at maturity for $997.00 at the time of purchase, effectively earning an annualized yield of 1.21% on the investment.

- Treasury notes are intermediate- to long-term investments, typically issued in maturities of two, three, five, seven, and 10 years. Interest is paid semi-annually.

- Treasury bonds cover terms of longer than 10 years, and are currently being issued in maturities of 30 years, with interest paid semi-annually.

About TIPS, STRIPS, FRNs, and U.S. savings bonds

Other forms of U.S. Treasury securities available to individual investors are TIPS, STRIPS, FRNs and U.S. savings bonds:

TREASURY INFLATION-PROTECTED SECURITIES (TIPS)

In 1997, the U.S. Treasury introduced notes and bonds in a new form designed to protect the investor from the effects of inflation. These inflation-indexed securities are known as Treasury Inflation- Protected Securities, or “TIPS.” Using the Consumer Price Index (CPI) as a guide, the value of the principal is adjusted to reflect the effects of inflation. A fixed rate of interest is paid semi-annually on this adjusted principal. At maturity, if inflation has increased the value of the principal, the investor receives the higher, adjusted amount back. If deflation has decreased the value, the investor nevertheless receives the original face amount of the security.

Here’s an example* of how inflation-indexed securities work:

- Let’s say you invested $1,000 in January in a new 10-year inflation-indexed note. The note pays 3.00% annualized interest semi-annually.

- At mid-year, the CPI indicates that inflation has been 1.00% during the first six months. Your principal is adjusted upward to $1,010 ($1,000 x 101%) and your resulting interest payment would be $15.15 ($1,010 x 3.00% ÷ 2, as interest payments are made semi-annually).

- At the end of the year, the index indicates that inflation was 3%, which brings the value of your principal up to $1,030. Your second interest payment would be $15.45 ($1,030 x 3.00% ÷ 2).

Because of the built-in inflation protection, these securities usually offer lower interest rates than U.S. Treasuries of similar maturities without this protection.

* This is a simplified example for illustrative purposes and does not necessarily reflect current market conditions.

SEPARATE TRADING OF REGISTERED INTEREST AND PRINCIPAL SECURITIES (STRIPS)

For many years, securities firms have offered special products to investors by separating the principal and interest (or coupon) components of U.S. Treasury securities, a process called “coupon stripping.” Initially, stripped securities were available only through proprietary programs of a few firms. However, since 1985, the process has been facilitated through the U.S. Treasury Department’s Separate Trading of Registered Interest and Principal Securities (STRIPS) program. Individuals who choose to invest in STRIPS want to receive a known payment on a specific date in the future.

STRIPS components – also called “zero-coupon” securities or “zeros” because they make no periodic interest payments – are traded as individual securities. For example, stripping a bond with 20 years to maturity generates 40 coupon STRIPS (one for each semiannual coupon payment) plus one principal STRIP. Once a bond is stripped, investors can buy any or all of the available components.

FLOATING RATE NOTES (FRNS)

In January 2014, the U.S. Treasury began issuing Floating Rate Notes (FRNs), which are debt securities that pay interest rates quarterly until maturity. FRNs are issued for a term of two years. Interest payments of FRNs change or “float” based on discount rates in auctions of 13-week Treasury Bills.

The price of an FRN is determined at auction, and it may be bought at a price that is greater than, less than, or equal to its face value. When the security matures, you are paid its face value. An FRN’s interest rate varies because it is the sum of the index rate and a spread. An index rate is tied to the highest accepted discount rate of the most recent 13-week Treasury bill, therefore it changes each week. The spread is the highest accepted discount margin in the auction where the FRN is first offered, and it remains the same for the entire life of the FRN.

There are two ways to bid for an FRN: non-competitive and competitive. Non-competitive bids can be placed online through an account on the federal government’s TreasuryDirect website at www.treasurydirect.gov, or through an intermediary such as a bank or broker.

FRNs are auctioned each month, with original issues in January, April, July and October. Reopenings, when additional amounts of a previously issued security are auctioned, are offered in the other months.

U.S. SAVINGS BONDS

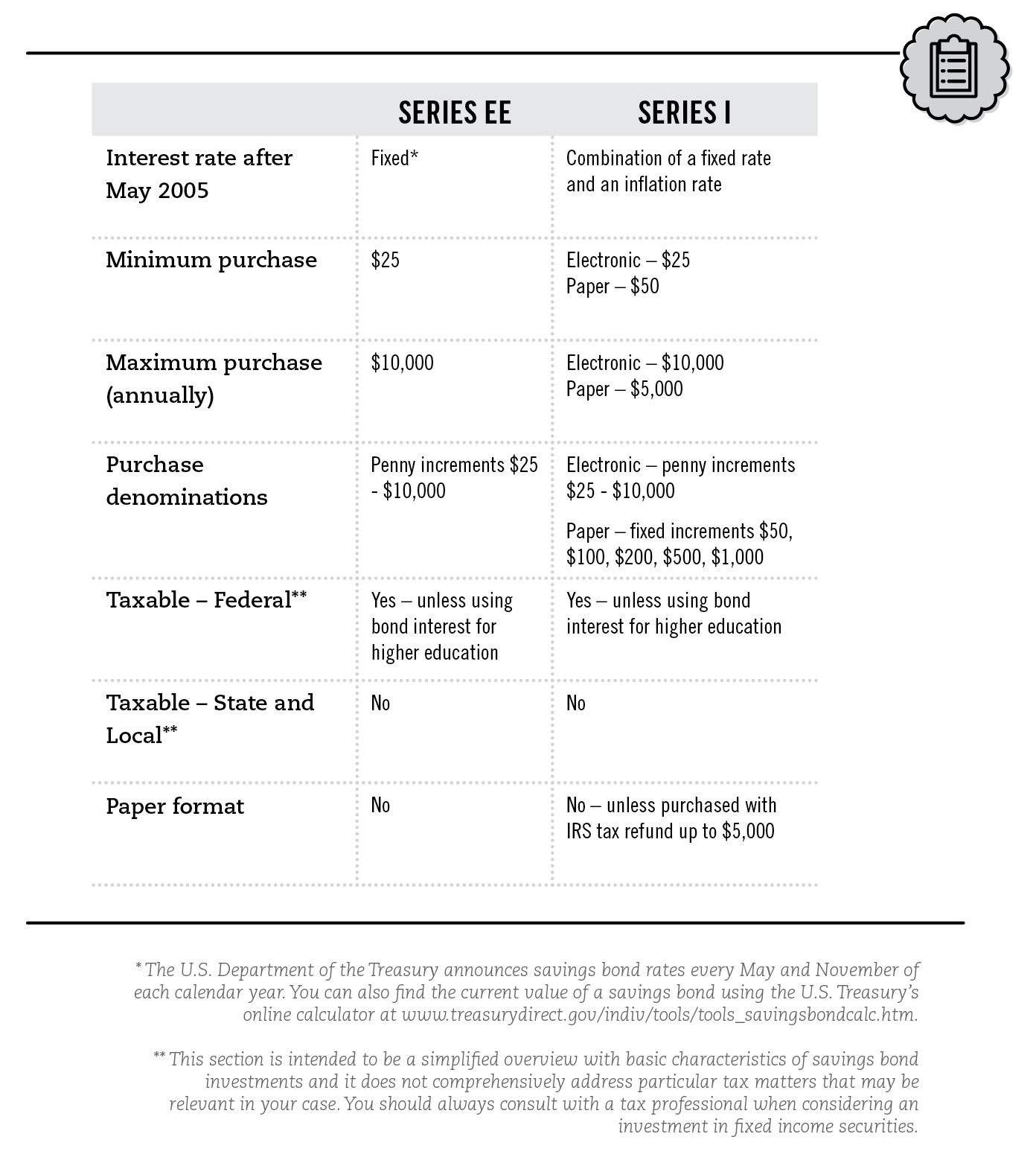

First introduced in 1935, a savings bond is a debt security issued directly by the U.S. Department of the Treasury. There are two types of savings bonds – Series EE and I. Both can be purchased online through an account on the TreasuryDirect website.

Historically, savings bonds were purchased in paper format through financial institutions but since January 2012, most savings bonds are issued in electronic format. However, I bonds are still available in paper format, but only when purchased with an IRS tax refund up to $5,000.

Savings bonds are purchased at face value – for example a $100 savings bond will cost $100 – and investors can buy them in penny increments, starting at $25 up to a maximum of $10,000 each year.

Investors in savings bonds earn a fixed rate of return for the life of the bond, which can be held for up to 30 years. Commonly used by investors to help finance college education, save for retirement, or as a gift to mark special events such as a graduation or special birthdays, savings bonds can be redeemed after one year. It is important to note that if a savings bonds is cashed in before five years, the last three months of interest is not paid.

Series EE and I savings bonds

The main difference between a Series EE bond and a Series I bond is that an I bond has a built-in inflation adjustment, paying interest based on a combination of a fixed rate of return and an inflation rate that the U.S. Treasury calculates twice a year based on the Consumer Price Index.

Understanding price and yield information

Price and yield are critical concepts for bond investors to understand. There is a tremendous amount of information available on prices and yields of Treasuries. One particularly helpful website for up-to-date information on Treasury securities of all kinds is the federal government’s TreasuryDirect site.

As described earlier, the price and yield of a U.S. Treasury security are related. From the time a bond is originally issued until it matures, its price in the marketplace will fluctuate depending on the particular terms of that bond as well as general market conditions, including prevailing interest rates, the bond’s credit rating and other factors. Because of these fluctuations, the value of a bond may be higher or lower than its original face value if you sell it before it matures.

In general, when interest rates fall, prices of outstanding fixed interest rate bonds rise. The inverse also holds true: when interest rates rise, prices of outstanding bonds fall to bring the yield of those bonds into line with higher-interest bearing new issues.

Buying and selling U.S. Treasury securities

Treasuries can be bought and sold through a financial professional, a commercial bank, an online broker, or the TreasuryDirect site. They can provide you with the most recent issues that are trading in the secondary market.

Investors may also choose to invest in a mutual fund or exchange traded fund (ETF) specializing in Treasuries rather than purchase individual securities. Some funds hold other fixed-income securities or derivatives along with Treasuries, so investors should be sure they understand the permitted investments as well as any fees or other charges.

Savings bonds (as described earlier) are not traded, unlike other marketable U.S. Treasury securities discussed in this guide. Owners of savings bonds cannot re-sell them or give them away to another individual. When purchasing a U.S. savings bond as a gift, the recipient will be registered as the sole owner of the bond and it will not count towards the purchaser’s annual purchase limit.

Glossary

Book-entry. A method of recording and transferring ownership of securities electronically, eliminating the need for physical certificates.

Coupon. The feature of a bond that denotes the interest rate (coupon rate) it will pay and the date on which the interest payment will be made.

Discount. The amount by which the par (or face) value of a security exceeds its purchase price.

Face (or Par or Principal). The principal amount of a security that appears on the face of the bond.

Interest. Compensation paid or to be paid for the use of assets, generally expressed as an annual percentage rate.

Issuer. The entity obligated to pay principal and interest on a bond.

Laddering. A technique for reducing the impact of interest-rate risk by structuring a portfolio with different bond issues that mature on different dates.

Liquidity (or marketability). A measure of the relative ease and speed with which a security can be purchased or sold in a secondary market.

Maturity. The date when the principal amount of a security is due to be repaid.

Par. See Face.

Principal. See Face.

Secondary market. Market for buying and selling previously issued securities.

Security. Collateral pledged by a bond issuer (debtor) to an investor (lender) to secure repayment of the loan.

Yield (or Current yield). The annual percentage rate of return earned on a bond calculated by dividing the coupon interest rate by its purchase (market) price.

Zero-coupon bond. A bond that does not make periodic interest payments before it matures. Instead, the investor receives one payment, which includes principal and interest, at redemption (call or maturity).