What is a Data Aggregator?

Understanding financial data aggregator services

“What we are trying to do at SIFMA on behalf of the industry is really to inform the public…what their responsibility and their rights should be with respect to…data that they share with various providers.” Kenneth E. Bentsen, Jr., President and CEO, SIFMA

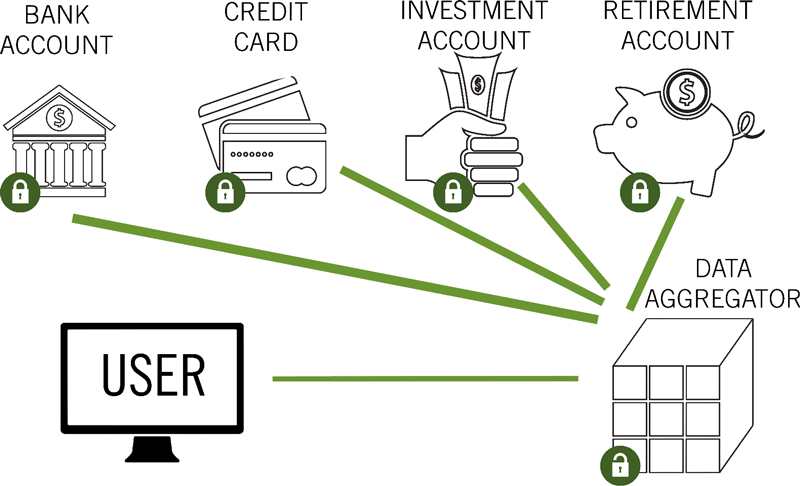

Getting a handle on your financial life can be a challenge. The average customer might have brokerage, checking and savings accounts, one or more credit cards, retirement plan accounts, each with monthly or quarterly paper or online statements.

Getting a handle on your financial life can be a challenge. The average customer might have brokerage, checking and savings accounts, one or more credit cards, retirement plan accounts, each with monthly or quarterly paper or online statements.

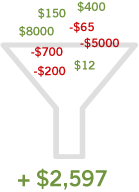

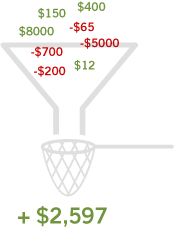

The proliferation of account information and printed statements across financial institutions means that many people may not see the full picture of how they are doing financially. Today’s technology makes it easier. Millions of customers are better able to see a consolidated picture of their finances or financial relationships by using aggregation websites and mobile applications to consolidate information imported from their various accounts. Customers can use these tools to do budgeting and planning, including understanding what they earn, spend, and owe.

Expert Insights: What is data aggregation

from Stuart Rubinstein, Fidelity Investments

Today’s aggregator apps (such as Mint, Personal Capital and YNAB) automate the collection process and provide a single visual display of financial information. To use these services, customers must authorize the aggregator to pull information from their online financial accounts regularly. This typically means, the customer must give the aggregator his or her confidential bank or investment log-in credentials for each of their accounts at different institutions. The aggregators use software to import the data automatically and regularly update that information on their platforms.

So, for example, let’s say you have a checking account with your local bank, a credit card issued by a financial institution, a retirement account with another financial institution, and an investment account with yet another. When you sign up with an aggregator service and provide them with your account log-in credentials, the aggregator uses that information to access each of your financial accounts, essentially as if they were you. The aggregator’s software pulls your financial data and information from those websites on an ongoing basis, then the aggregator consolidates your data onto its online platform. This process allows you to see conveniently all of your account information on your desktop computer or mobile device.

Here are some relevant questions to consider when you decide to use a financial data aggregation service:

- Are you sharing your confidential account log-in credentials with third-parties not associated with your financial institutions?

- What are aggregators doing with the data you share with them?

- Do you know how to stop sharing your financial information with aggregators?

While we don’t want to go back to the days of storing paper statements in shoe boxes, it is critically important in a time of massive data breaches and mishandling of data that consumers know who is accessing their sensitive financial and personal information and how they are using, storing, and sharing it.

In our next article, we’ll take a closer look at those potential challenges and how the industry is taking steps to protect customer data.